RiskMan

SRRI

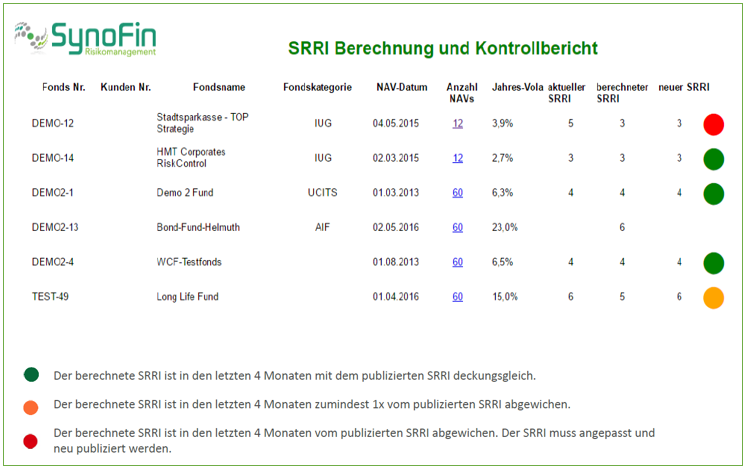

The RiskMan Modul SRRI determines the Synthetic Risk Reward Indicator (SRRI) as a standardised risk ratio on a scale from 1 to 7 using observed historical volatilities of the performance over the last 5 years.

Data is imported via a defined process and a previously specified standard interface.

This indicator is calculated in accordance with the law (CESR/10-673) on the basis of the available NAV history of a fund and compared with an already published SRRI.

Any missing NAV history is supplemented by the establishment of a target asset allocation that is as close as possible to the actual allocation of the portfolio. The historical volatility is determined by using a sample portfolio or a benchmark mix.

The Sliding Window Test is used to determine the need for change and to reduce the change frequency of the KIID. In this 4-month observation window, a new KIID must be created if all recalculated values of the fund lie outside the original SRRI value.

Using the SRRI report, you can make an adequate decision on a possible SRRI change in good time if the last 4 months indicate several different risk classes.

Are you interested or do you have any questions ?

Make an appointment now.