RiskMan

Worst Case Finder

Traditional stress tests carry the risk that loss calculations in hypothetical scenarios may give a false illusion of certainty if there are much more dangerous scenarios of similar plausibility. The scenarios usually considered, which simulate past extreme situations, are financial-mathematically and stochastically implausible. This leads to the decision dilemma: "Should we restructure our portfolio if a bad loss occurs in a 1000 year scenario? In addition, uncritically used proxy solutions (e.g. DAX-Underlying for all DE securities) result in strong smoothing of the risk exposure and thus a considerable underestimation of the risk in the stress scenario.

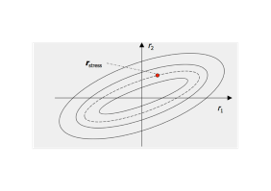

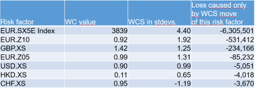

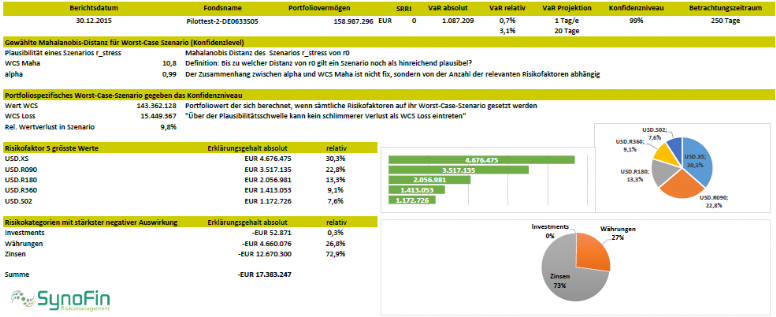

The stress test scenario technique of the RiskMan Worst Case Finder offers a solution. The concept for Worst Case Finder was developed at the Austrian National Bank in order to determine systemic risks from financial instruments in banks and funds through stress tests. In order to arrive at plausible scenarios, all relevant risk factors of each portfolio must be determined separately. This can be solved using financial mathematics over the so-called Mahalanobis distance. Subsequently, the Worst Case plausibility above a defined threshold can be determined. The central statement of this worst case search is: "Above the plausibility threshold, no worse loss than kmax can occur".

Due to its hierarchical and granular structure and the development language Matlab, the Worst Case Finder is predestined for the risk calculation of common and complex financial instruments. With the integrated multi-processor capability, even very large and complex portfolios with conventional server equipment can be calculated in minutes.

Are you interested or do you have any questions ?

Make an appointment now.