RiskMan

Backtesting and Stress tests

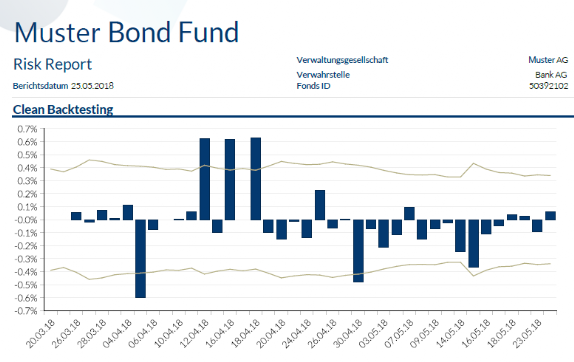

RiskMan backtesting enables the calculated Value at Risk to be back-tested with profits and losses from historical price calculations on the basis of the price calculations of imported funds.

In accordance with the principle of clean backtesting, the value at risk is calculated on the basis of the one-day Monte Carlo value at risk, with the option of VaR scaling for lower or higher NAV calculation frequencies. Special rules exist for some derivative instruments.

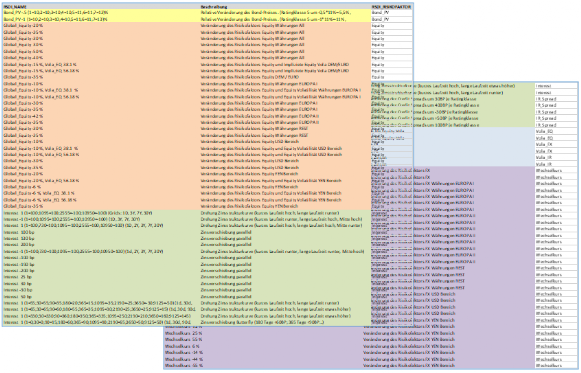

In addition to instrument and/or fund-related stress tests, RiskMan Stress Testing also provides you with over 100 individual stress scenarios in any combination.

The following stress test groups can be calculated and adjusted and/or extended on request: Bond PV, equity, interest rate, interest spread, volatility and exchange rate stress tests.

With Worst Case Finder, RiskMan has the unique option of using a financial mathematical function to determine the most realistic and at the same time most negatively effective scenario for each portfolio and to make the central statement: "Above the defined plausibility threshold, no worse loss than kmax can occur for this portfolio".

Are you interested or do you have any questions ?

Make an appointment now.