RiskMan

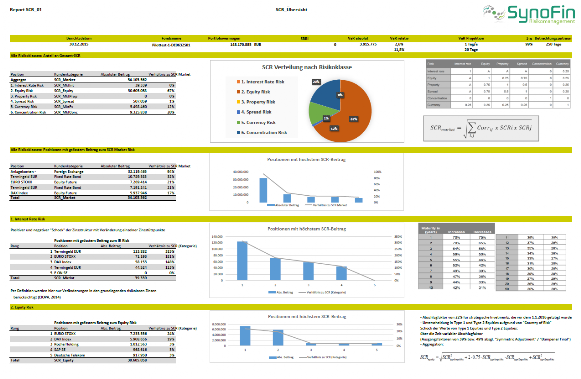

SCR Solvency

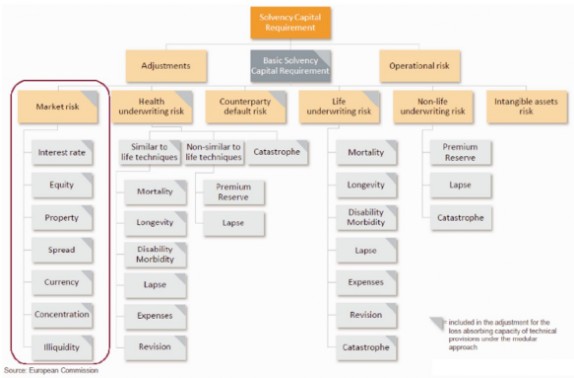

The RiskMan SCR Module determines the aggregate of the correlation-weighted products of the "Solvency Capital Requirements" of the individual risk classes.

The Interest Rate Risk is calculated by approximating the risk resulting from changes in value that arise from an increase/decrease in the basic risk-free interest rates for each currency at different maturities.

In Equity Risk, a distinction is made between type 1 equities (securities listed in regulated markets in member states of the EEA or OECD) and type 2 equities (other equities and alternative investments in hedge funds, private equity, etc.). Type-specific discount factors are used to calculate the changes in value from price or volatility changes.

Property Risk results from changes in the value of assets and liabilities as a result of a direct reduction in property prices, whereby collective real estate investments are reported under equity risk.

In Spread Risk, a distinction is made between bonds, securitisations and credit derivatives and an approximation of the risk due to changes in value resulting from changes in credit spreads is determined. For credit derivatives, the loss resulting from a direct increase/decrease in credit spreads is calculated.

Currency Risk represents the risk arising from changes in the relevant exchange rates. Reduced discount factors are applied for currencies with pegging.

In Concentration Risk, a relative exposure per counterparty adjusted for credit quality is determined and then weighted with a specific risk factor. The risk resulting from changes in value that arise from the concentration of investments with individual counterparties is calculated.

The results are available online immediately after calculation, as an SCR-report or as an export file.

Are you interested or do you have any questions ?

Make an appointment now.